The Indian Goods and Services Tax (GST) is changing again. At the 56th meeting of the GST Council, the government approved reforms to simplify GST slabs. These changes will take effect from 22nd September 2025. The new regime is meant to make GST more transparent, easier to understand, and fairer for both consumers and businesses.

For many, however, these changes raise a common question: “How much GST do I actually need to pay under the new slabs?” Manually calculating can be confusing, especially with revised categories and exemptions. That’s why we’ve created a free GST calculator updated for the new GST rates 2025. It gives you instant, accurate results so you can focus on your business or purchases without worrying about tax errors.

Whether you’re a small business owner, freelancer, accountant, or everyday shopper, understanding the new GST rates 2025 and using the right tool will save you both time and money.

What’s New from 22nd Sept? (GST Slab Changes)

Here are the factual changes as of 22 September 2025, based on official PDF/notification from the GST Council and Finance Ministry.

- The old slabs of 5%, 12%, 18%, and 28% are being rationalised into a simpler structure.

- The main effective GST rates now are: 5% (for daily essentials, household goods, medicines, and priority sectors) and 18% (for most goods & services).

- A higher rate of 40% is introduced for luxury, sin goods, and certain demerit items.

- A zero or nil rate (0%) remains for essential items like fresh food, some medicines, educational goods, health services, etc.

There are exceptions and transitional rules:

- Items like Special category demerit items etc., may continue under existing rates (28% + cess) until certain financial obligations (like compensation cess or loan repayments) are satisfied.

- Bricks also have special treatment in some states; some notifications show bricks retaining a particular GST rate for now.

So-6%, 10%, 30%, 20% which were in your table are not correct according to latest official sources. The rates to be used are 0%, 5%, 18%, 40%. There is no official 6%, 10%, 20%, 30% slab in the new GST framework per recent GST 2.0 reforms.

Why This Change Matters

The new GST rates 2025 are more than just numbers; they affect how businesses bill, how consumers shop, and how freelancers price their services.

- For consumers: Daily items like basic food, toiletries, medicine become cheaper (5% or 0%). Luxury items or “sin goods” get taxed much higher (40%), so costlier. This directly affects household budgets.

- For small businesses and retailers: All pricing, inventory, billing systems, invoices must get updated. Selling with old slabs after 22 Sept could invite compliance issues.

- For accounting & bookkeeping: Using wrong GST rates can lead to errors in input tax credit (ITC), wrong GST collection, and possible penalties.

- For product categorization: HSN codes (Harmonised System of Nomenclature) become more important. Whether something falls under essential, standard, or luxury/sin affects rate.

- For public revenue: Though GST is simplified, the government expects revenue effect from higher rates on sin/luxury goods, from changes in ITC, etc.

How to Calculate GST with New Slabs

With the new slabs (0%, 5%, 18%, 40%), here’s how to calculate:

- GST Amount = (Base Price × GST Rate) ÷ 100

- Final Price = Base Price + GST Amount

Examples

- Essential good (say medicine or staple food)

- Base price = ₹1,000

- GST rate = 5%

- GST = (₹1,000 × 5) ÷ 100 = ₹50

- Final price = ₹1,050

- Luxury / sin good (Special category demerit items)

- Base price = ₹2,000

- GST rate = 40%

- GST = (₹2,000 × 40) ÷ 100 = ₹800

- Final price = ₹2,800

- Standard goods/services (electronics, many services)

- Base price = ₹5,000

- GST rate = 18%

- GST = (₹5,000 × 18) ÷ 100 = ₹900

- Final price = ₹5,900

If something is zero-rated (0%), GST = 0, so you pay just the base price.

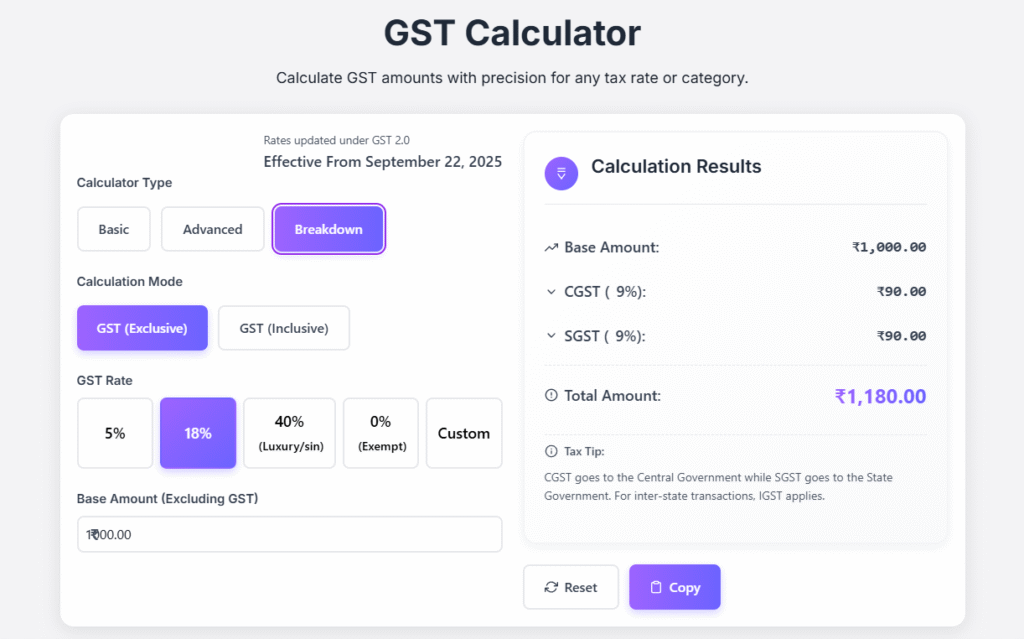

Free GST Calculator (Interactive Tool)

Because the rate structure has changed, manual calculations (especially across many items) can become error-prone. Here’s how the tool you built can help, and how to use it correctly under the new GST 2.0 rules:

How the GST Calculator Tool Works (Step by Step)

- Enter Base Price: Provide the cost of the good or service before GST.

- Select Applicable GST Slab: From options like 0%, 5%, 18%, 40%. The tool should reflect that 5% is for essentials, 18% for most goods/services, 40% for luxury/sin items, and 0% for exempted or zero-rated supplies.

- Calculate: The tool computes GST amount and total price automatically.

- View Breakdown: It shows you – base price, GST amount, final price. Possibly also how much you save or pay extra compared to old slab (if you want).

What to Watch Out For with the Tool

- Make sure the list of slabs in your dropdown or input matches the official ones (0%, 5%, 18%, 40%). If your tool still has “12%”, “28%”, or “30%” etc., they need updating.

- For goods/services with exceptions (like Special category demerit items) which continue under old rate + cess for now, the tool could have a note or separate path.

- If the tool supports HSN code lookup or classification, that helps users pick the right slab.

Key Features of Our GST Calculator

Our online GST calculator 2025 is designed to be simple, fast, and accurate. Here’s what makes it stand out:

- Updated Slabs

- Uses the latest GST rates effective from 22nd September 2025 (0%, 5%, 18%, 40%).

- Automatically adjusts for future updates as per GST Council notifications.

- Instant Results

- Enter your amount, select a rate, and get GST amount + total instantly.

- No need for manual formulas or spreadsheets.

- Mobile-Friendly Design

- Works smoothly on desktops, tablets, and smartphones.

- Responsive layout with clean interface for fast calculations on the go.

- Tax Breakdowns

- Shows base price, GST component, and final amount separately.

- Useful for invoices, billing, and tax filing.

- Easy-to-Use Interface

- Simple dropdowns for GST slab selection.

- Minimal learning curve — anyone can use it.

Benefits of Using Our GST Calculator

Why should you use this calculator instead of manual math or generic apps? Here are the advantages:

- Accuracy: Our tool helps you estimate GST amounts based on current slabs for billing or tax returns.

- Time-Saving: Calculate GST in seconds, even for bulk entries.

- Compliance-Friendly: Stay aligned with GST 2.0 rules from Sept 22 onwards.

- Business Ready: Perfect for small businesses, freelancers, accountants, and e-commerce sellers.

- Consumer Transparency: Shoppers can check if they are being charged correctly.

- Free Forever: No login, signup, or hidden charges.

FAQs

Q1. What are the official new GST rates 2025 from 22 September?

They are 0%, 5%, 18%, and 40%. Most items fall under 5% or 18%; only luxury or sin goods get taxed at 40%; essentials and certain medicines/services are zero-rated or exempt.

Q2. Does the 12% or 28% rate still exist?

Generally no. Most goods previously taxed at 12% or 28% have been moved into 5% or 18% as part of GST rate rationalisation. Some exceptions like Special category demerit items etc., may continue temporarily under old structure + cess until further notifications.

Q3. Will the “new GST calculator” be accurate?

Yes – if it uses the updated slabs (0%, 5%, 18%, 40%) and takes into account any exceptions. As long as you update the tool’s rate options, it will compute correctly.

Q4. Do I need to re-label or re-price stock purchased earlier?

Stock or invoices already sold before 22nd Sept remain valid. Manufacturers/retailers should revise price tags or supplementary price lists for new stock or new invoices. Re-labelling of older stock isn’t mandatory if transparency is maintained at point of sale.

Q5. How will input tax credit (ITC) be affected?

Since rates have changed, raw materials at old rates vs finished goods at new rates could cause mismatches. Businesses should reconcile old & new rate purchases. Also, for sin/luxury goods, high rate + cess means higher tax input and output. Correct GST calculation (with updated slabs) helps avoid mismatches or loss of credit.

Q6. How can I quickly check the impact of the new GST rates 2025?

Use our free calculator – just enter your amount, select the updated slab, and see the final price instantly.

Conclusion

Here’s the bottom line: The GST overhaul effective 22nd September 2025 simplifies things. The new rates are 0%, 5%, 18%, and 40%. Slabs like “6%”, “10%”, “20%”, “30%” are not part of the official structure. If your calculator tool reflects old rates, it must be updated.

Using the GST calculator tool with the correct slabs keeps your pricing accurate, avoids legal or audit trouble, and helps you avoid surprises. The new GST rates 2025 bring clarity and simplification. With our updated calculator, you can instantly see the impact of these revised slabs on your business or personal expenses.

Disclaimer: The GST rates mentioned are for informational purposes. While we strive for accuracy, users are advised to verify rates with the official GST portal (cbic-gst.gov.in) before filing taxes.